Massive Federal Loan Program For Small Businesses Off To Rocky Start

4/3/2020

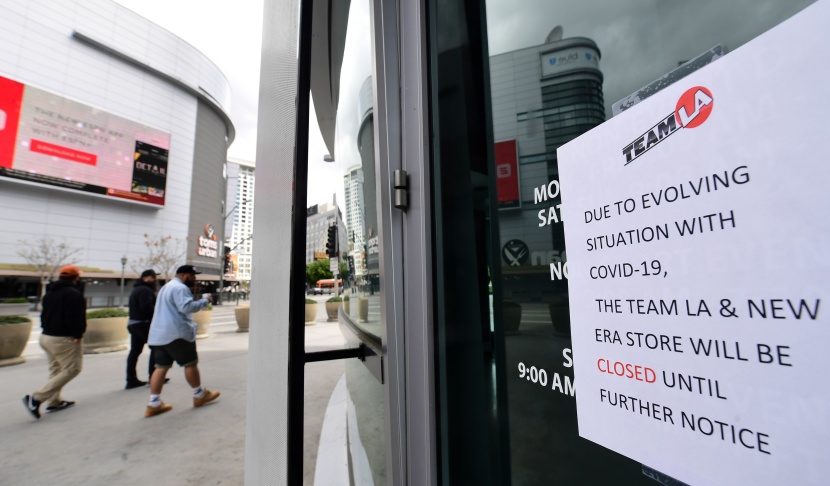

Today is the first day that small businesses affected by the COVID-19 pandemic can apply for $349 billion in loans from the Paycheck Protection Program, which is part of the stimulus package passed by Congress last week.

But that money might not last long or get to the people who need it most.

HELPS TO KNOW A GUY

The small businesses owners with the best chance of receiving a loan are those that already have a relationship with a bank and have their finances in order — like Steve Grandjean, who runs Gourmet Imports in Alhambra.

He spent all week talking to bankers about how to apply for the Paycheck Protection Program. Those loans will be forgiven if business owners use them to pay employees' salaries, rent and utilities.

"I'm being very proactive about reaching out to everyone I know," Grandjean said. He asked his banker if there was some way to put his application at the front of the line because he worries the Small Business Administration, which is backing the loans, will be "completely overwhelmed."

"IT'S UNIMAGINABLE HOW BIG IT IS"

Indeed, by 8:40 a.m. on Friday, banks had already processed $875,000,000 worth of loans.

Leon Blankstein, who heads the American Business Bank in downtown L.A. and said he has not slept in two days, said the demand for these loans from his clients is "incredible. It's unimaginable how big it is."

He said it's a race to get loan applications in before the money runs out. In fact, his co-workers are taking bets on how soon that will happen— a few hours, a few days?

LEFT OUT

Blankstein worries that because the money could run out quickly, it won't get to the small business that need it most.

"You ask one of our vendors who sells clothes on the sidewalk, she's not even aware, probably, that the loan is available," said Rudy Espinoza, the director of Inclusive Action for the City, a nonprofit that helps street vendors.

Many street vendors likely wouldn't be eligible for the Paycheck Protection Program anyway. Applicants must be a U.S. citizen or permanent resident to qualify.

That means L.A. County's approximately one million undocumented immigrants are left out.

"It's just like anything else that we do," Blankstein said. "It's really not getting to the people who need the help."

OFF TO A ROCKY START

By 10 a.m. on Friday, there were already signs that many small business owners were struggling to apply for the loans.

People complained that banks they already had existing relationships with — specifically, Bank of America — were disqualifying them.

Others complained their bank's website kept crashing.

Others said their banks weren't even taking applications yet.

U.S. Sen. Marco Rubio (R-FL) took some of those big banks to task on Twitter in a video posted from his home.

Hearing reports that some big banks are creating unnecessary restrictions on #SmallBusiness applying for #PPPloan pic.twitter.com/UhllrZhYpy

— Marco Rubio (@marcorubio) April 3, 2020